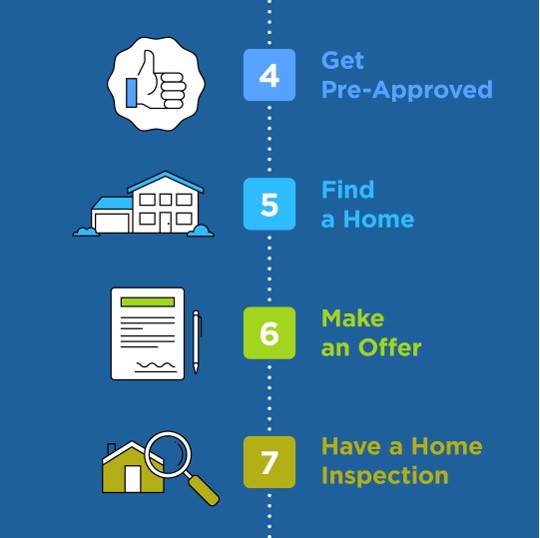

Steps for Buying a Home

* I always recommend that you actually talk to a lender as soon as you think you might want to buy to see what down-payment-assistance programs you qualify for! Plus they can give you tips on ways to clean up your credit if you need to.

I know a great local Portland lender you will definitely benefit from a conversation with!

Documents your Lender will want (for step 4):

- A month’s worth of your most recent pay stubs

- Copies of your last 2 years’ federal tax returns and W-2s

- The names and addresses of your employers over the last two years

- Last 3 months of bank statements

- The names and addresses of your landlords over the past 2 years

- Divorce/separation papers

- Child support papers

- Bankruptcy/discharge of bankruptcy papers

Got Questions?

Feeling confused, or maybe this seems a little intimidating? That’s why I’m here! There are no stupid questions. Ask away!

While there is a specific path to buying a home, WHEN that path begins and HOW LONG it needs to take it up to YOU and your personal situation. Having a guide like me is the best way to make sure that timeline actually happens how you want.

You can also learn more about some of the DPA (Down Payment Assistance) programs in the Portland Metro area here.