Is now a good time to buy a house?

The answer is… for most people, yes.

The TL;DR version of this article (that’s “too long; didn’t read”) is that YES, NOW is the time to buy.

But it does depend on what your situation is.

- If you want to buy a home but you need to sell your current home first, click here for more about this.

- If you need to be in a new home soon (maybe because of a job, or school), then you should buy now. Wasting time in a rental only pays someone else’s mortgage. Plus you’ll be missing out on equity now, and you’ll likely have to move at some point later anyway, when it may be less convenient for you.

- If you WANT to be in a home soon, but there are no time constraints (maybe you live with family now, or you are on a month-to-month lease), then it is STILL a good time to buy. Why? Keep reading:

Here’s what you need to understand about the current market’s shift:

- Interest rates are going up. The Fed does not intend to cut rates until at least 2024, and DOES plan to INCREASE them at least twice before then. They’re doing this to try and stop inflation, and maybe even begin an economic recession. In a recession, mortgage rates will likely go back down. According to Fortune.com, “Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough.” If you buy a home now and rates do go down significantly in the future, you can refinance down to that lower rate. If you choose to WAIT instead, you’ll be waiting a while, at least until 2024. In the meantime your rent can go up (by as much as 14.6% in your current place) and you definitely won’t be gaining any equity on your rental.

- Home prices are DECCELERATING. This does not mean prices they are losing value. It means prices aren’t going up as quickly as they were over the past 2 years during Covid. UPDATE: Some forecasts are that home prices may actually go DOWN in 2023, learn about that HERE.

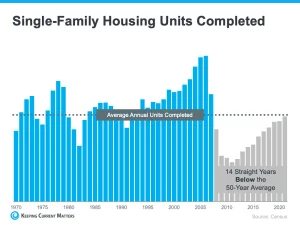

- Inventory is not going up. Let’s say inflation cools down, and rates go down too so you could theoretically get a cheaper house. There simply aren’t enough houses for everyone who is looking for one. Supply shortage = high demand = high prices.

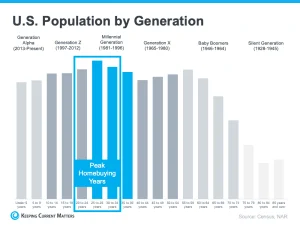

The thing about waiting is, you’re not the only one doing it. Waiting may put you into a market with

lower mortgage rates, but it will put you into competition with the millions of people who also waited. The demographic of people who typically buy houses is the largest group of people in the country.

More buyers = higher demand = higher home prices.