Are Home Prices Going to Go Down?

The Cost of Waiting

“I want to wait for home prices to go down before I buy.” I hear this from renters all the time. There are a couple problems with this thinking:

1. Let’s say home prices DO go down (and some forecasts are indicating they may do so by as much as 7% in 2023). That doesn’t mean homes will always be cheaper. HUH? WHAT?! This is because INTEREST RATES affect your monthly payment more than the sales price. And interest rates are on the serious climb.

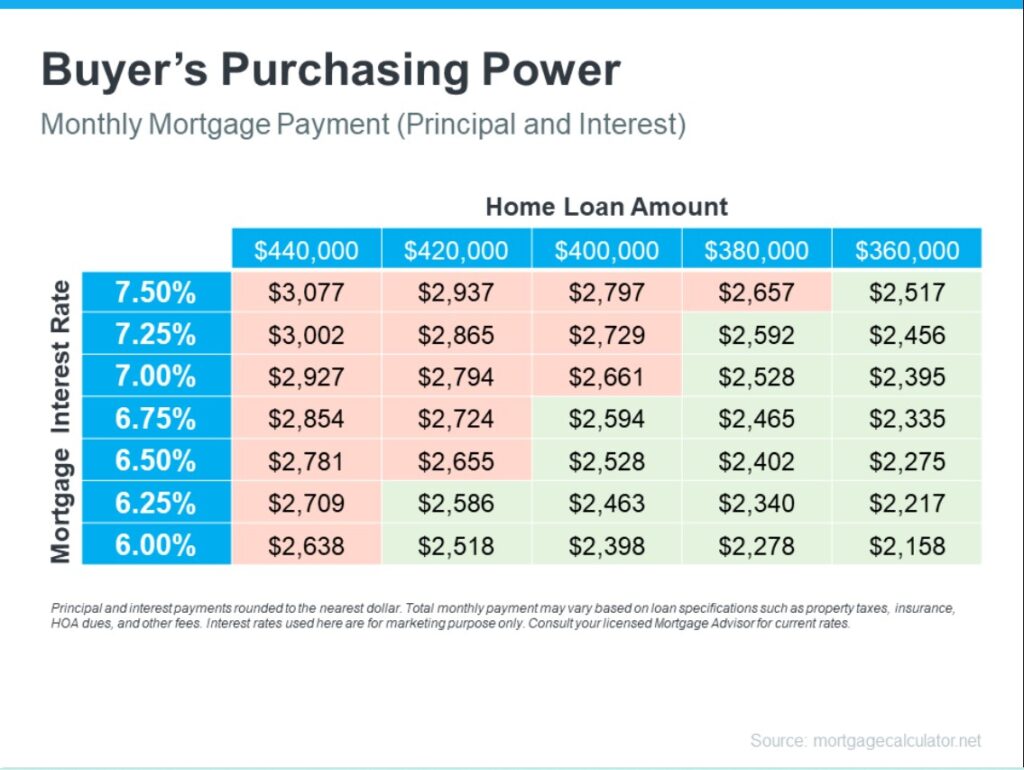

Check out this example: In the “Buyer’s Purchasing Power” graph you can see that a $440,000 home costs LESS per month than a $380,000 home if the interest rate is increased by 1.5% (which is likely to happen before the end of 2022). Let’s say the sellers of a $440,000 home lower their asking price by 7% to keep up with market trends. That only drops the price to around $410,000. If you can only afford $2600 a month, and interest rates go up 1.5%, you might be able to afford the home at $440,000 today, but you would not be able to afford it in a few months when interest rates go up –even at $410,000.

The Fed plans to increase interest rates at least 2 more times in 2022, which will likely result in interest rates close to 7.5%. They also said they have no plans to lower rates until 2024.

2. Even if an economic “crash” happens, home prices likely WON’T go down by much. Why? The short answer is lack of inventory. There simply aren’t enough homes for the people who want to buy them. And do you think builders build new homes in a recession? Not so much.

3. Your rent is likely to increase over the next few years if not sooner. In Oregon in 2023, landlords are allowed to increase your rent by 14.6% with 90 days notice. If you move, the landlord at the new places you’ll be looking at can charge however much they want, no matter what the previous tenants were paying.

Who should NOT buy now?

Real estate agents love to say, “Now is a great time to buy!” And while it IS usually a true statement for most people if they can afford it (because homes generally don’t lose value over time), buying a home is a super personal decision. The “best time” for it depends on what is best for you.

If you know you will need to move out of the city/state in less than 5 years, you are probably better of just renting.

If you are in a well-priced rental now and you can comfortably afford up to 15% more each year for the next few years (which is the amount your rent may increase each year), you might be better off just staying there.

If you have no idea what you want in the next 5 years, you are probably better off not getting tied down to one property.

If you have no idea what you want, but want to learn more about the benefits of owning a home, or have questions about what it takes to even start thinking about it, I’m happy to chat with you and answer your questions. Hit me up!